Ireland's Property News

Property prices see fastest growth since May 2015

Property prices see fastest growth since May 2015.

Residential property prices posted their fastest annual growth in almost two years in February, lifted by sharp increases outside of Dublin.

New figures from the Central Statistics Office show that residential property prices rose by 10.7% in the year to February - the fastest growth rate since May 2015.

This compares to an increase of 8.1% in the year to January.

The CSO also said that property prices increased by 1.5% in February compared to the previous month.

In the 12 months to February, the average market price for a property was €245,165.

House price growth has begun to accelerate again in recent months amid a lack of supply. An easing of Central Bank lending rules and the new Government help-to-buy subsidy has seen mortgage approvals surge.

Today's CSO figures show that Dublin property prices increased by 8.3% on an annual basis, with house prices up 8.1% and apartment prices rising by 9.1%.

The CSO noted that the highest house price growth was seen in the Dublin City area with growth of 9.2%, while the lowest growth levels were seen in Fingal with house prices rising by 3.7%.

Meanwhile, residential property prices in the rest of the country jumped by 13.2% in the year to February.

House prices in the rest of the country rose by 13.1% while apartment prices increased by 13.9%.

According to today's figures, the West Region showed the steepest price growth, with house prices racing 19.8% higher. The Mid-East region showed the slowest rate of growth with house prices growing by a still strong 9.3%.

They also reveal that the average price paid by households was higher in Dublin than in any other region or county at €398,319.

Of the four administrative areas of Dublin, Dún Laoghaire-Rathdown was the most expensive, with an average price of €555,346 for a property over the 12 month period.

South Dublin was the least expensive, with an average price of €313,506.

After Dublin, the next most expensive region was the Mid-East, where the average price paid by households was €244,271. Within this region, Co Wicklow was most expensive, with an average price of €313,023.

The least expensive region for household purchases over the last 12 months was the Border region, with an average price of €115,207.

The cheapest county in which to buy a property was in Co Longford with an average price of €87,584.

Today's CSO figures also reveal that in the year to February, the most expensive Eircode area for household dwelling purchases was D06 'Dublin 6', with an average price of €724,711.

The least expensive Eircode area over the last 12 months was F45 'Castlerea', with an average price of €69,808.

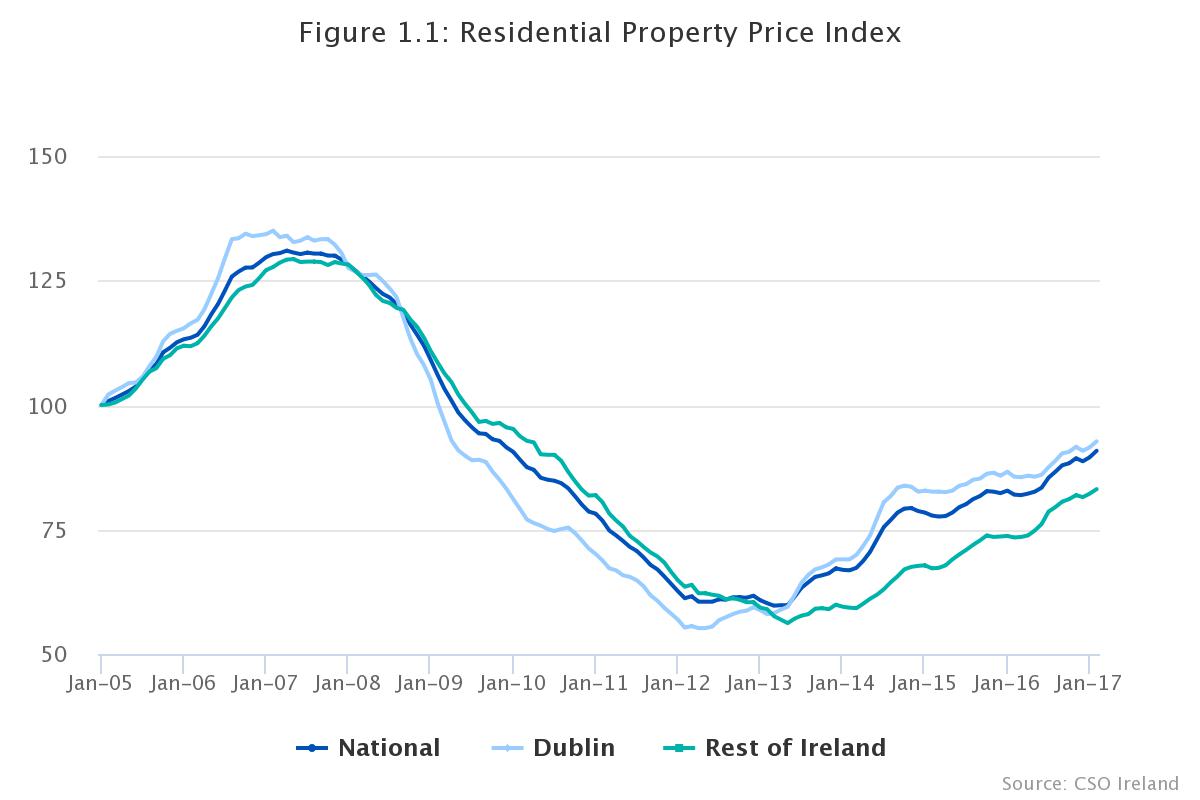

Overall, the national residential property price index is still 30.7% lower than its highest level in 2007.

Dublin home prices are 31.3% lower than their February 2007 peak, while prices in the rest of the country are 35.7% lower than their May 2007 peak.

Inflation forecast may be too weak

In its assessment of the housing market, Davy said it had expected residential property prices to rise by 10% this year, as the country's "robust economic recovery was always likely to lead to significant house price rises.

"The key uncertainty is how much extra momentum to Irish house price inflation has been added by the Help-to-Buy scheme and the loosening of the Central Bank mortgage lending rules.

"The sharp gains in the early part of 2017, when price rises are normally muted, indicate that our forecast for 10% house price inflation might even be too pessimistic."

Source : RTE 19/04/2017

Comments